- Banking licence for its German CSD marks final CSDR licence for Clearstream

- CSDR represents major step towards a harmonised European post-trade space

Deutsche Börse Group’s post-trade services provider Clearstream has obtained the CSDR licence for banking services for Clearstream Banking AG, its German central securities depository (CSD). The licence was granted by the German Federal Financial Supervisory Authority BaFin pursuant to Art. 54 CSDR (banking services). The authorisation is effective as of 24 August 2021.

#Clearstream Banking AG just received the #CSDR licence for banking services. This marks the final move in achieving full CSDR compliance across Clearstream’s CSDs: a major step for Clearstream and towards a harmonised #European #posttrade space. https://t.co/cfASeuNW8q pic.twitter.com/TQmispbCSo

— Clearstream (@Clearstream) August 25, 2021

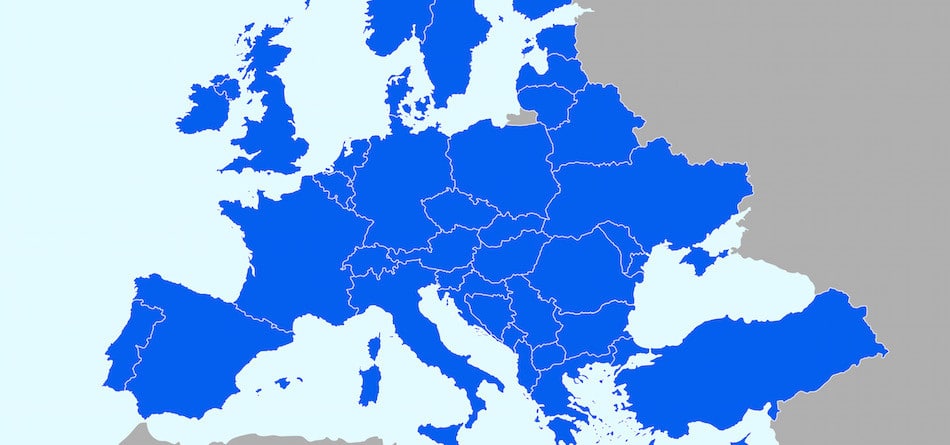

The Central Securities Depositories Regulation (CSDR) set out with the goal to make markets more stable, transparent and efficient by regulating securities settlement and settlement infrastructures in a harmonised manner across the European Union. CSDR entered into force in 2014; industry implementation of its CSD-specific measures is ongoing.

This authorisation represents the final step in achieving full CSDR compliance for all of Clearstream’s CSDs. Clearstream’s German CSD, international CSD (ICSD, Clearstream Banking S.A.) and Luxembourg CSD (LuxCSD S.A.) already hold licences pursuant to Art. 16 CSDR. Its ICSD also holds a licence for banking services and an interoperable link (“Bridge”).

Source: Clearstream