Wall Street’s adoption of open-source development has come to a crossroads, according to recent research published by industry analyst firm Aite Group.

In the 28 years since Linus Torvalds released his open-source Linux operating system kernel, it has taken 23 years for the adoption of the development model to gain prominence with financial services institutions, according to Tosha Ellison, director of member success at the Fintech Open Source Foundation as whose organization sponsored the research,

“I’m still surprised when I talk about open source with great technologists who are doing exciting things that I sometimes get back blank looks,” she told IntelAlley.

“It was surprising to learn just how mature a few firms are with their approach towards open source engagement,” agreed Spencer Mindlin, an analyst at Aite Group and one of the report’s authors. “Although it is fairly understood that most firms utilize a significant amount of open-source code in their software stacks, they lack of maturity to most firms in the capital markets towards an open-source strategy was revealing.”

Of the 15 global capital markets firms interviewed for the study, the consumption of open-source technology is well entrenched and dwarfs the contributions to the open-source community by the firms.

A CTO of an unnamed bank estimated that more than 85% of the firm’s Java-based applications are open source applications, according to the report’s co-authors Virginie O’Shea, research director at Aite Group, and Mindlin.

Aite Group

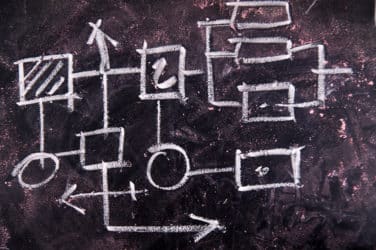

“One large bank Aite Group interviewed shared how it is tracking almost 12,500 open-source projects within its technology stack,” they wrote. “Most large banks maintain a developer request workflow. To manage the requests, some banks have a specialized and dedicated software packaging team that knows how to evaluate and bring new open-source packages into the software development environment.”

Contributing code to the open-source community still needs to overcome the c-suite and its direct report’s fear, uncertainty, doubt that any contributions would risk losing intellectual property and competitive advantage.

“There is a real risk in releasing any software out into the market,” noted Ellison. “You have to make sure that you have appropriate security checks in place, know where the software is coming from, and make sure that you are not releasing any proprietary or client data. But that is true with any outward-facing software.”

Open-source software introduces additional concerns, such as proper open licensing selection as well as understanding the full dependency stack, she added.

However, there is only so much open source adoption that can occur from the grassroots up within the highly regulated financial services industry.

Establishing a top-down management approach to open source is also critical for reaping the most cost savings, innovation, and talent attraction and retention from adopting open-source development.

“It’s the sort of thing that people at the top need to be very deliberate about, set in place the policies, processes, and technology to leverage open source, and then allow their lieutenants on the front lines make the game-time decisions as to how best to engage with open source,” said Mindlin. “Otherwise, a firm is not taking full advantage of the goings-on in open-source software development.”